- Book Your Stay

- Modify Booking

- Cancel Booking

- Book My Dining

- Book My Event

Preferred at the park

- Overview

- Benefits

- Earn points

- Redeem Points

THE Park Preferred is an exclusive membership to the finest collection of boutique hotels in India,THE Park Hotels.

THE Park Hotels, pioneers of luxury boutique hotels in India, is present in India’s major cities and leisure destinations. Situated in prime locations, we house some of India’s most inventive restaurants, liveliest bars and happening nightclubs. THE Park is present in Bangalore*, Chennai*, Hyderabad*, Kolkata*, Navi Mumbai, New Delhi* and Visakhapatnam.

Experience a world where design and style converge to create spaces that are as unique as you; where colours and textures conspire to create rooms full of ideas; where food take on refreshing new avatars to present a vibrant palette of flavours; where personalised and efficient service come together to pamper you with luxury and comfort.

A World of Benefits & Privileges Awaits You.

Start earning from dining to staying and redeem your points for food & beverage offers, room upgrade, spa therapies and much more.

Unlock the ANYTHING BUT ORDINARYTM

*A member of Design HotelsTM

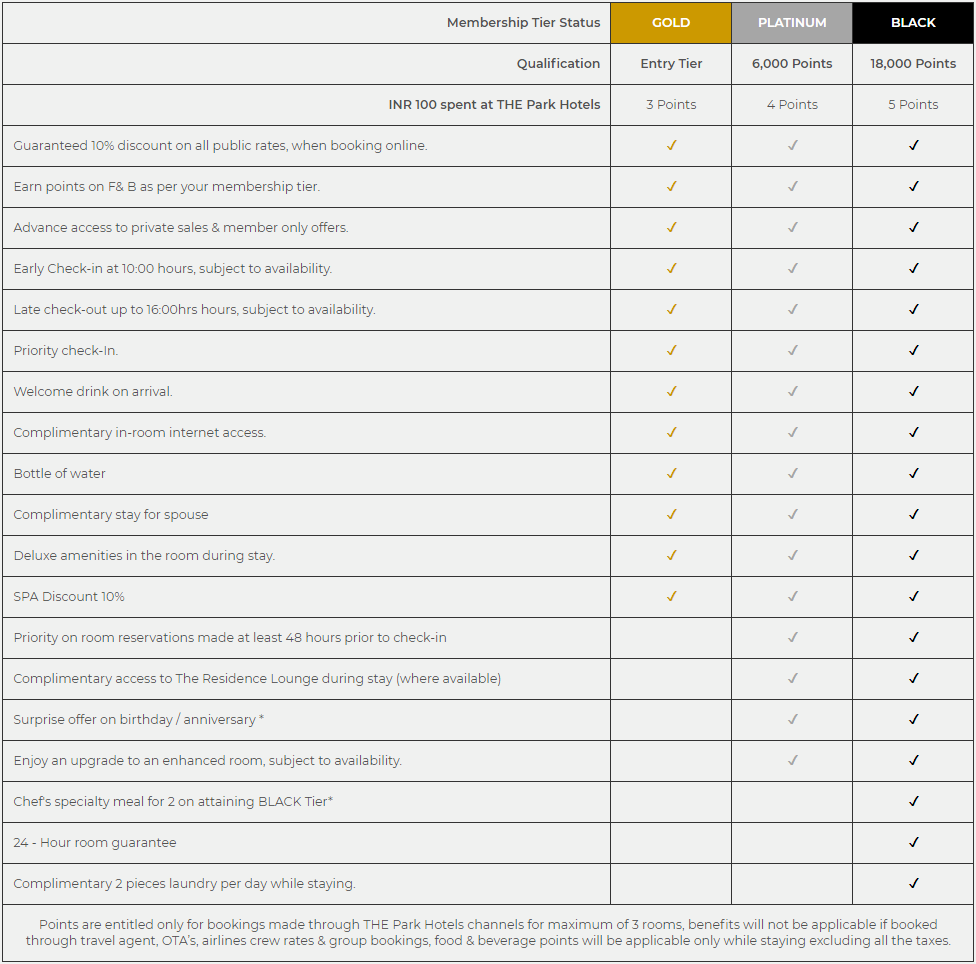

Member Benefits

Prepare for a new experience...

THE Park Preferred gives you instant benefits on every stay when you book directly through our channels.

THE Park Preferred program introduces tier based membership that allows you to indulge in a world of benefits and privileges created especially for you. As member you earn points on room rate, including dining, drink and spa, collect points and redeem them to enjoy privileges.

Membership Tiers:

- GOLD

- PLATINUM

- BLACK

|

Membership Tier Status |

GOLD |

PLATINUM |

BLACK |

|

Qualification |

Entry Tier |

6,000 Points |

18,000 Points |

|

INR 100 spent at THE Park Hotels |

3 Points |

4 Points |

5 Points |

|

Guaranteed 10% discount on all public rates, when booking online. |

✓ |

✓ |

✓ |

|

Earn points on F& B as per your membership tier. |

✓ |

✓ |

✓ |

|

Advance access to private sales & member only offers. |

✓ |

✓ |

✓ |

|

Early Check-in at 10:00 hours, subject to availability. |

✓ |

✓ |

✓ |

|

Late check-out up to 16:00hrs hours, subject to availability. |

✓ |

✓ |

✓ |

|

Priority check-In. |

✓ |

✓ |

✓ |

|

Welcome drink on arrival. |

✓ |

✓ |

✓ |

|

Complimentary in-room internet access. |

✓ |

✓ |

✓ |

|

Bottle of water |

✓ |

✓ |

✓ |

|

Complimentary stay for spouse |

✓ |

✓ |

✓ |

|

Deluxe amenities in the room during stay. |

✓ |

✓ |

✓ |

|

SPA Discount 10% |

✓ |

✓ |

✓ |

|

Priority on room reservations made at least 48 hours prior to check-in |

✓ |

✓ |

|

|

Complimentary access to The Residence Lounge during stay (where available) |

✓ |

✓ |

|

|

Surprise offer on birthday / anniversary * |

✓ |

✓ |

|

|

Enjoy an upgrade to an enhanced room, subject to availability. |

✓ |

✓ |

|

|

Chef's specialty meal for 2 on attaining BLACK Tier* |

✓ |

||

|

24 - Hour room guarantee |

✓ |

||

|

Complimentary 2 pieces laundry per day while staying. |

✓ |

||

|

Points are entitled only for bookings made through THE Park Hotels channels for maximum of 3 rooms, benefits will not be applicable if booked through travel agent, OTA’s, airlines crew rates & group bookings, food & beverage points will be applicable only while staying excluding all the taxes. |

|||

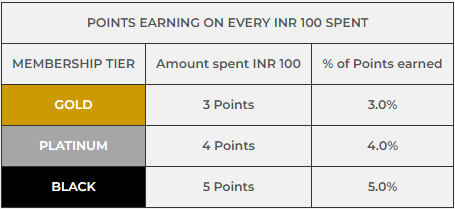

Earn Points

Earning points just got better…

You earn preferred points when you stay with us, when you dine* or use our SPA at any of our participating hotels.

Your Preferred Points are yours to enjoy, use it for free nights or relish them for meal, enjoy privileges through our online catalogue.

For every qualified stay, earn 3% Preferred Points on room rate, including dining & spa.

The higher the membership tier, the more Preferred Points you get – Earn more Preferred Points and unlock new member tier and get additional member benefits. Earn 4% Preferred Points on reaching PLATINUM Tier and 5% Preferred Points once you reach BLACK tier.

|

POINTS EARNING ON EVERY INR 100 SPENT |

||

|

MEMBERSHIP TIER |

Amount spent INR 100 |

% of Points earned |

|

GOLD |

3 Points |

3.0% |

|

PLATINUM |

4 Points |

4.0% |

|

BLACK |

5 Points |

5.0% |

Preferred Points earned with every INR 100 spent at GOLD tier = 3 Points, PLATINUM tier = 4 Points & BLACK = 5 Points

Pay back value of each point is INR 1 for redeeming.

Use Points

It’s so easy to redeem points…

Ready to reward yourself? Simply sign in and use your points for instant room night purchase, free nights, exclusive dining and lifestyle experiences.

- Reward Stay - The choice is yours! Use your Preferred Points for a reward stay with any of THE Park Hotels when booking a stay, Preferred Points are one of your payment options which means you can book more and earn more.

- THE Park Stays - Use your Preferred Points to enjoy one-of-a-kind experiences made-to-measure premium stays. Enjoy luxury package stays that are specifically designed for THE Park Preferred members.

- Anything But OrdinaryTM Experiences - THE Park Hotels is where unusual experiences are possible. When you stay with us, you are continuously delighted, making our luxury hospitality experience, and you, Anything But OrdinaryTM.

- Eat & Drink - Whether you are trying a new wine or having dinner at your favourite restaurant, redeeming Preferred Points has never been so entertaining. Members can enjoy more value on dining redemptions and unlock more delicious rewards and experiences.

- Spa & More - Hot stone massage? A relaxing sauna chamber? Yoga classes? Use your Preferred Points at THE Park Hotels' award winning luxury day spa and gym 'Aura'.

-

Prlvileged WiFi

-

Pay later

-

Easy Cancellation

-

Easy Upgrade